Are you too old to start your own business?

If you are in the later stages of your career and considered such a question, we have some data that can help you.

Global Entrepreneurship Monitor, a consortium of national country teams that carries out survey-based research on entrepreneurship around the world, collects a significant amount of primary data on senior entrepreneurship via the annual Adult Population Survey (APS). Responses from approximately 3,000 individuals in the United States provides valuable insight into the entrepreneurial activity of US seniors

Entrepreneurial Attitudes

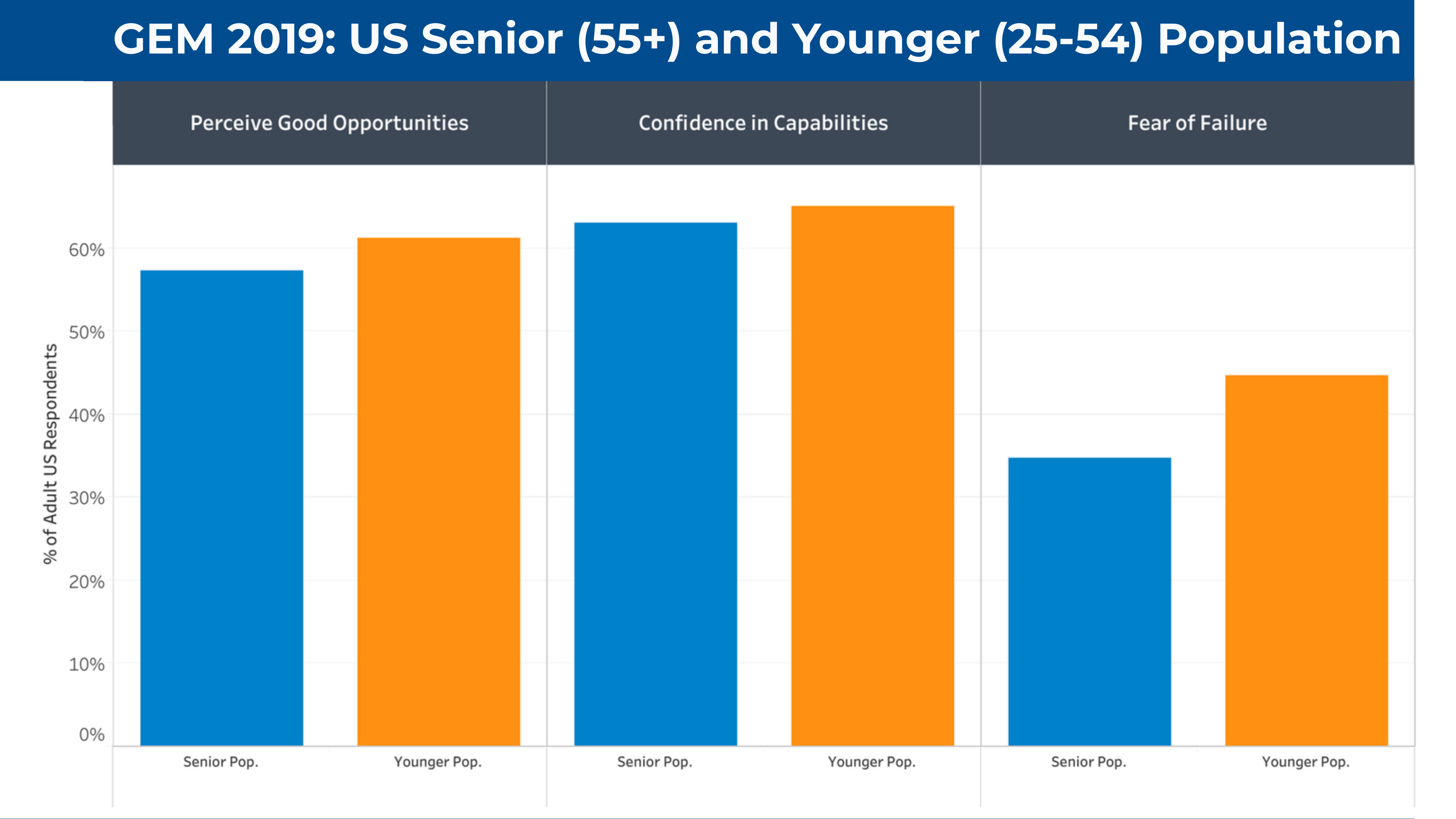

GEM uses several measures to determine an adult population’s attitudes towards entrepreneurial activity. The three indicators most often used by policymakers and researchers to gauge this entrepreneurial attitude are Perceived Opportunities, Perceived Capabilities, and Fear of Failure. Taken together, these indicators tell us if a population perceives good opportunities for starting a business, that they have the capabilities to run that business, and if they would fear failure in that pursuit. If they score relatively high on the first two indicators (Opportunities and Capabilities), and lower on Fear of Failure, it can indicate that a population is entrepreneurially confident.

Below, the rates of these indicators are provided for the US senior population (age 55 and over), compared to their younger population cohort of American adults, ages 25-54, from our most recent survey (2019, pre-COVID).

Perhaps unsurprisingly, senior entrepreneurs are less likely to be involved in planning or starting a very new business. The majority of senior entrepreneurs are owners of established businesses. As the graphic above shows, 14.1% of the surveyed US senior population owns a business over 42 months old (established business), compared to 11.3% of the younger cohort.

The fact that seniors tend to own older businesses is a significant advantage for their ability to withstand external economic shocks, such as temporary closures. Indeed, studies indicate that younger firms are less likely to survive such shocks.

Entrepreneurial Stage

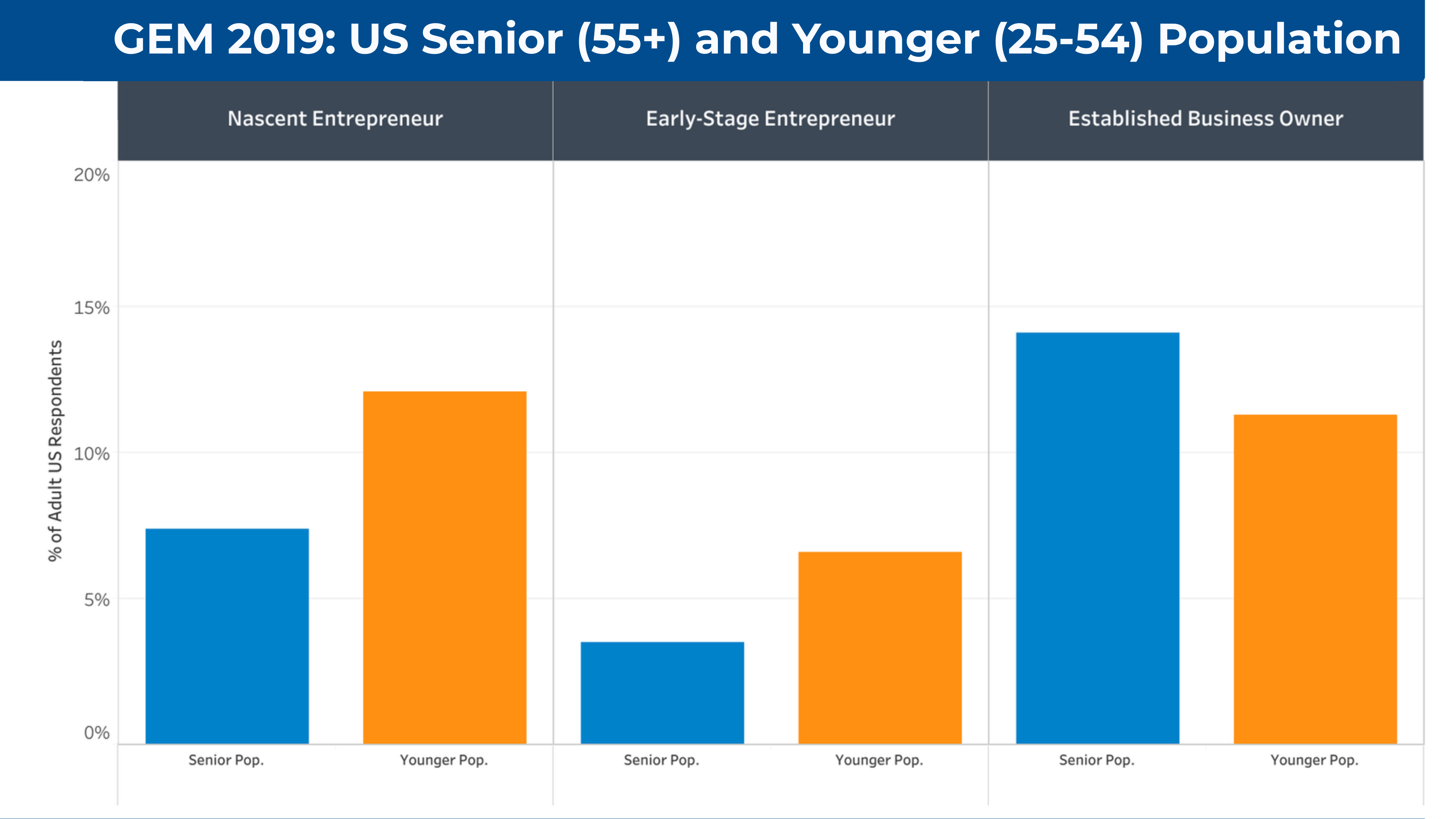

Beyond measuring entrepreneurial attitude, the APS also asks active entrepreneurs what stage their business is in. The three stages of business in the GEM framework are as follows: 1) nascent business owner (in the phase of actively planning a new business); 2) baby business owner (a business started within the last 42 months); or 3) established business owner (owning a business over 42 months old). Below, the rates of these indicators are provided for the US senior populations as well as the younger populations of ages 25-54.

Perhaps unsurprisingly, senior entrepreneurs are less likely to be involved in planning or starting a very new business. The majority of senior entrepreneurs are owners of established businesses. As the graphic above shows, 14.1% of the surveyed US senior population owns a business over 42 months old (established business), compared to 11.3% of the younger cohort.

The fact that seniors tend to own older businesses is a significant advantage for their ability to withstand external economic shocks, such as temporary closures. Indeed, studies indicate that younger firms are less likely to survive such shocks.

Entrepreneurial Sectors

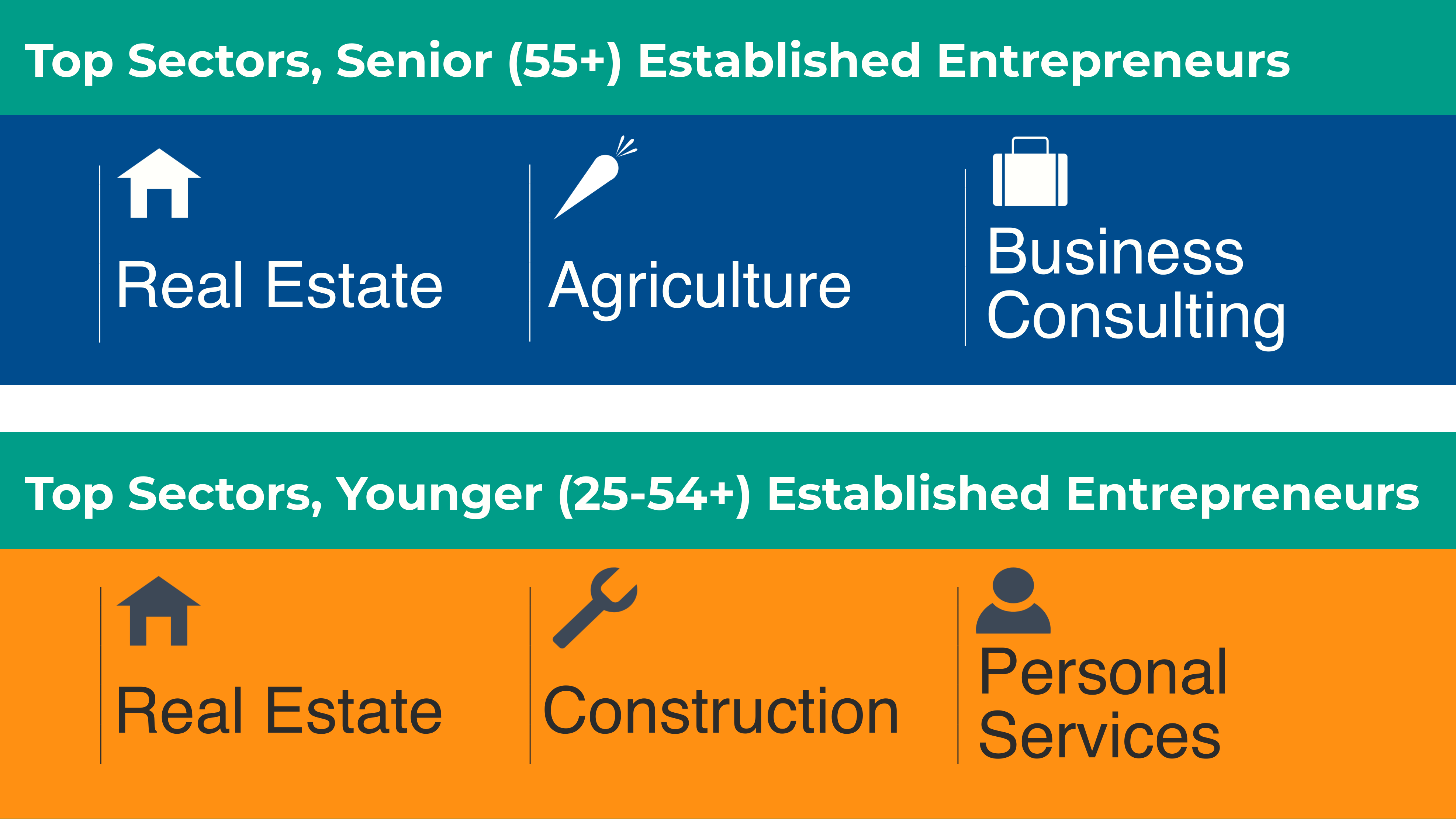

During the COVID-19 era, the type of business one owns correlates significantly to survival. Those businesses sectors with high rates of interpersonal interaction, such as beauty services, hospitality, and entertainment have had to endure major restrictions and an uncertain future. Conversely, those professional services that can be done remotely, or with careful interpersonal interaction, have been able to continue working. Given this reality, the distribution of business sectors between younger and older entrepreneurs again tends to favor the older cohort. Below, the top three most common sectors for both sets of entrepreneur groups are listed by the corresponding business stage.

While both seniors and younger entrepreneurs are exposed to COVID-related economic challenges, seniors are less exposed based on their choice of sectors. Seniors entrepreneurs, particularly those in established businesses where they have a higher representation, are more likely to work in low-interpersonal contact sectors such as real estate, agriculture, and business consulting. While of course real estate can have plenty of human contact in “normal” times, it has been reasonably adapted to COVID-19 condition, particularly when you consider that the real estate sector includes collecting rent on owned properties.

Younger entrepreneurs, in both baby and established business stages, are more exposed to sectors affected by COVID. For example, construction is the second most popular sector in both stages. While construction activity has recently returned to pre-COVID levels in the US, it is noteworthy that the entire industry declined 30% in April 2020. Considering the US is entering, or possibly already in, a second wave of COVID-19 closures, this puts younger entrepreneurs in the construction sector at considerable risk again. Similarly, beauty services, which are the third most common baby business among younger entrepreneurs, is one of the most vulnerable sectors to COVID-related regulations, with many businesses having to close at various times over the country.

As we enter the ninth month of COVID-related business disruption, resiliency will be key in entrepreneurs’ survival. Despite the current difficulties, many senior entrepreneurs may be able to weather the storm due to their experience and choice of business. Some even see it as an opportunity. As Stephen Solosky, founder of the Traveling Professor states, “As a senior entrepreneur, we see this as an opportunity. We are aggressively pursuing new clients. We are also forging new business relationships with vendors and suppliers who are now willing to work with a company of our size.”

Perhaps now you might have a different perception about whether the older population should venture into entrepreneurship.

Forrest Wright is a Data Manager for the Global Entrepreneurship Monitor.