The COVID-19 pandemic caused considerable uncertainty for most entrepreneurs globally during the summer of 2020.

Logically, the levels of uncertainty depended on the pandemic’s impact on the location of the entrepreneur, the extent of the government’s mandated closures and the level of the business’s in-person interaction. Counterintuitively, this uncertainty was more likely to have a negative impact on “established businesses” as opposed to early stage businesses.

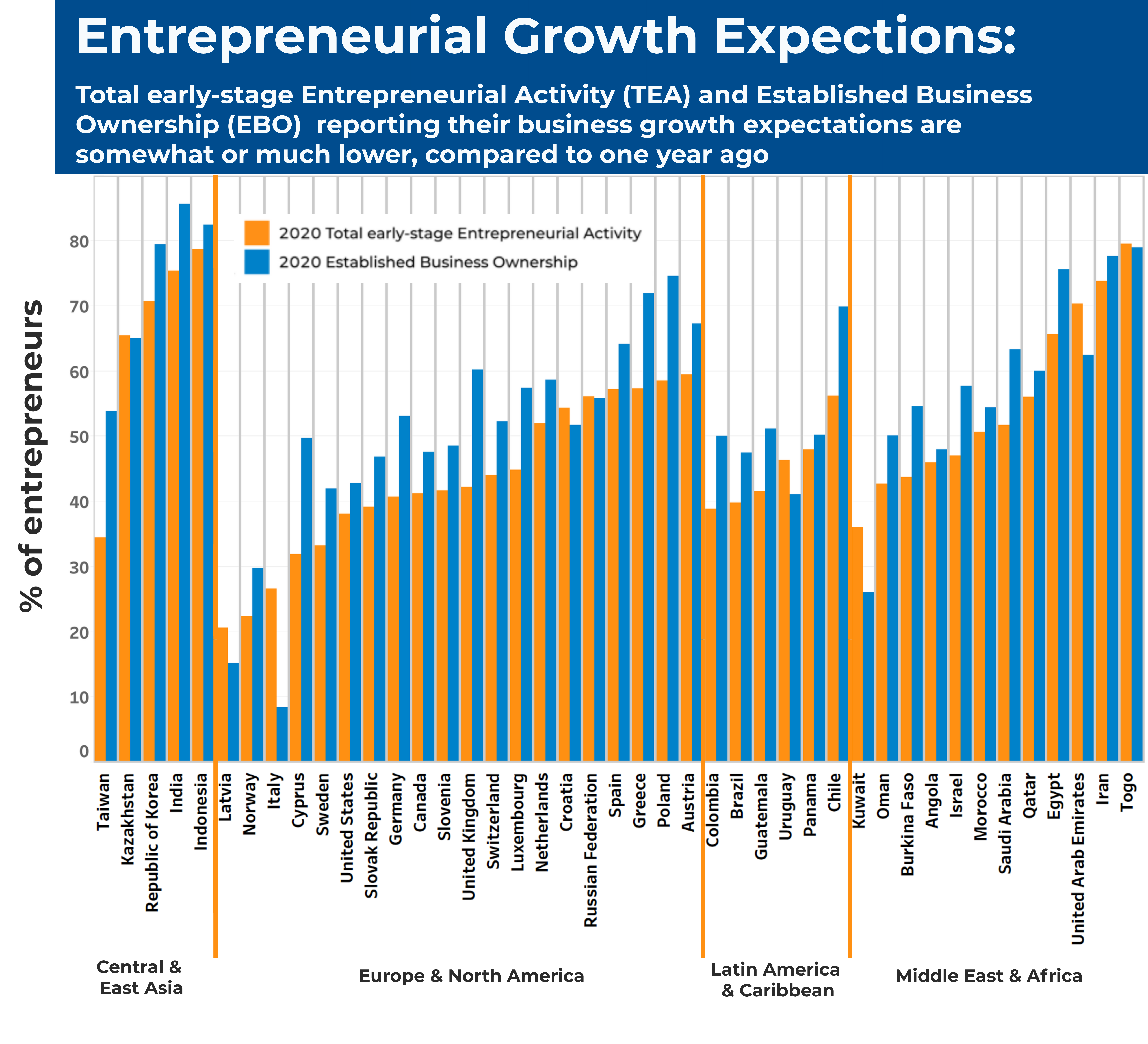

In general, early-stage entrepreneurs tended to see more opportunities in the pandemic, perhaps because they had more flexibility to pivot, than those who had been operating their businesses for more than 42 months. Additionally, early-stage entrepreneurs tend to be less pessimistic in their future growth projections.

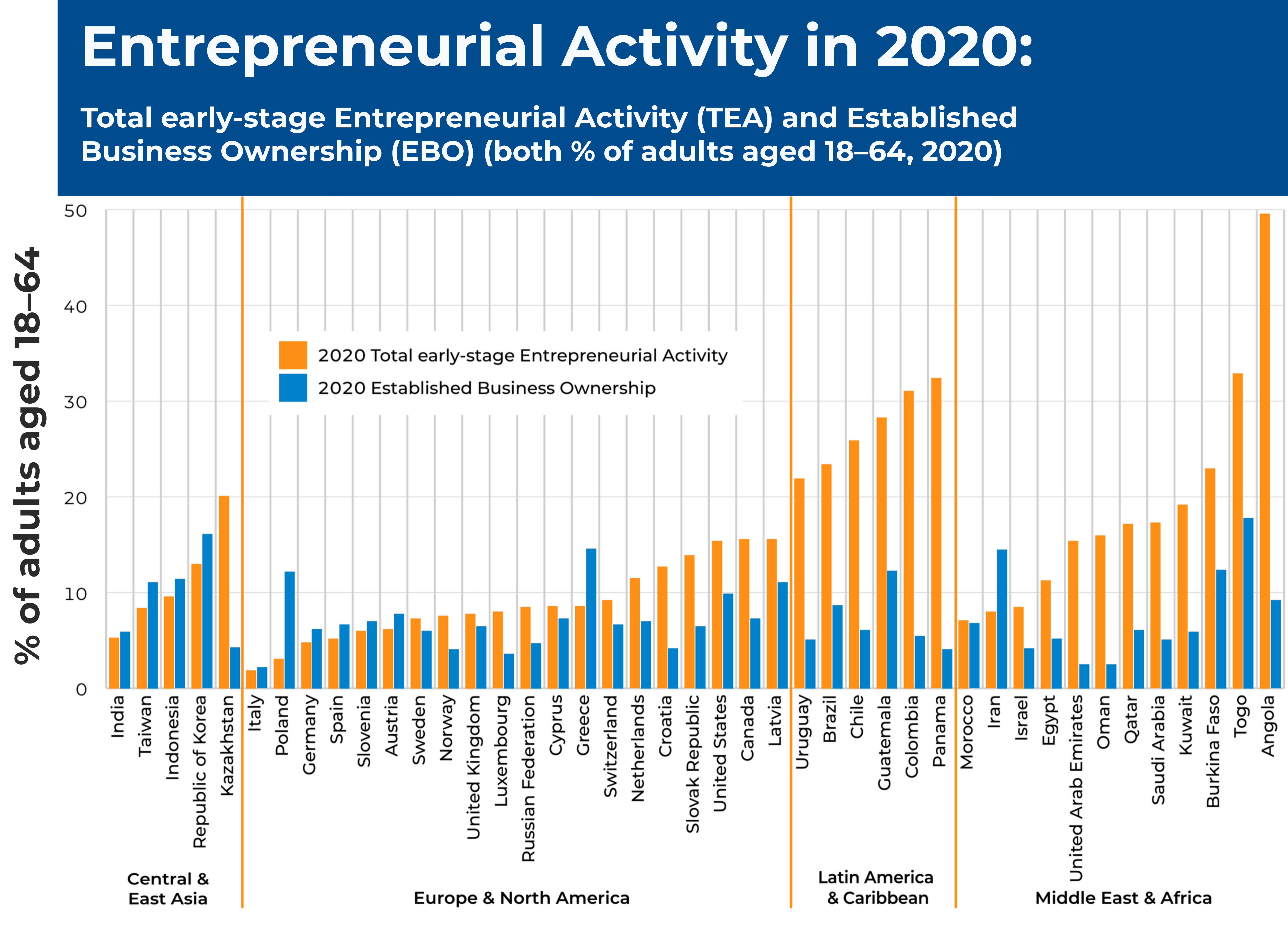

There are more early-stage entrepreneurs in the planning and/or early-management phase of their venture, than there are “Established Business Owners,” who own or manage a business in operation over 42 months. Below is a graph highlighting the Total Early-stage Entreneurial (TEA) and Established Business Ownership (EBO) rates for all 43 participating GEM economies from our 2020/2021 Report.

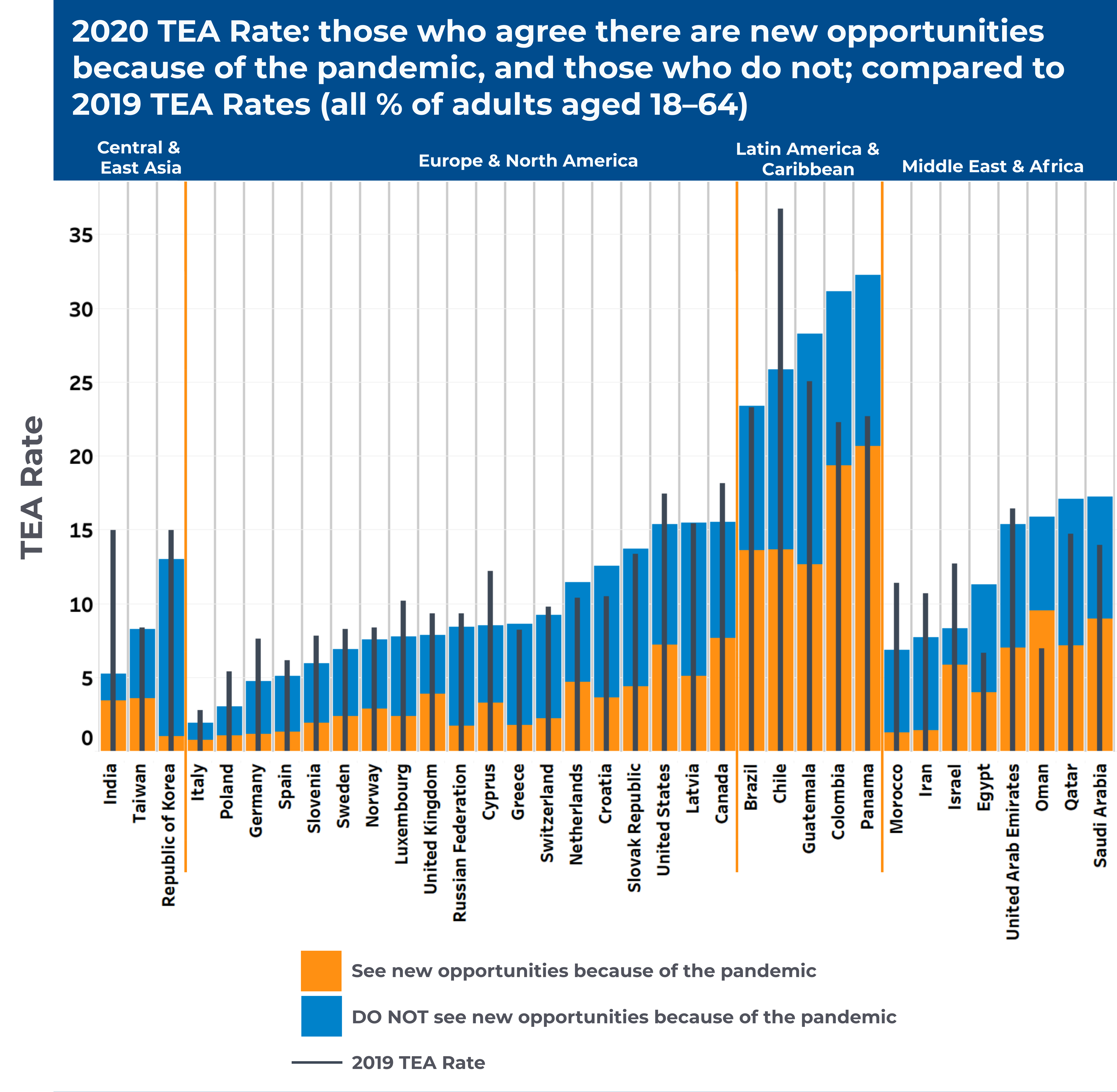

Not only are the percentage of early-stage entrepreneurs more numerous in most economies, they tend to be more optimistic. This is particularly true when it relates to the COVID-19 pandemic. In the 2020 GEM Adult Population Survey, both sets of TEA and EBO were asked if they agreed that they saw opportunities as a result of the pandemic. In all but a couple economies, TEA respondents were much more likely to see opportunities as a result of the pandemic.

This optimism can also be seen in the relative growth expectations between both sets of TEA and EBO groups. While the disparity between both sets of entrepreneurs is not as wide when it comes to growth expectations, there was still a stronger consensus among established business owners that growth would be somewhat or significantly lower in 2020 compared to one year ago. Below, we see both sets of entrepreneurs, ranked by what percentage of each group reported they have lower growth expectations compared to one year ago. These responses of course would have been impacted by the decrease in business activity experienced across all economies in 2020 as a result of the pandemic.

Whether or not this is a concerning disparity remains to be seen. Certainly, the COVID-19 pandemic is still a public health emergency in many regions, and has also reshaped those economies. It is therefore possible that those entrepreneurs who are not sufficiently reactive could continue to suffer as a result of failing to see opportunities. This failure to react would affect established businesses more than early-stage businesses according to the 2020 Adult Population Survey results. Conversely, it may be possible that as economies return to a semblance of “normal,” established businesses can continue operating without needing to consider the pandemic as much as they would have during the worst stretch of 2020.

Therefore, policymakers and researchers should monitor the 2021 GEM Adult Population Survey results with particular interest. With these results, we will have more evidence of whether or not entrepreneurs succeeded as a result of their response to the pandemic, as well as how the entrepreneurial activity rates of entire economies were affected by these choices.