A 1997 SEC filing found that Jackie and Mike Bezos, parents of Amazon founder Jeff Bezos, invested $245,573 in their son’s company in 1995. It was a certainly a worthwhile investment for the elder Bezos. According to GEM research, there are many moms, dads, sisters and brothers who invest in their family members’ business ideas.

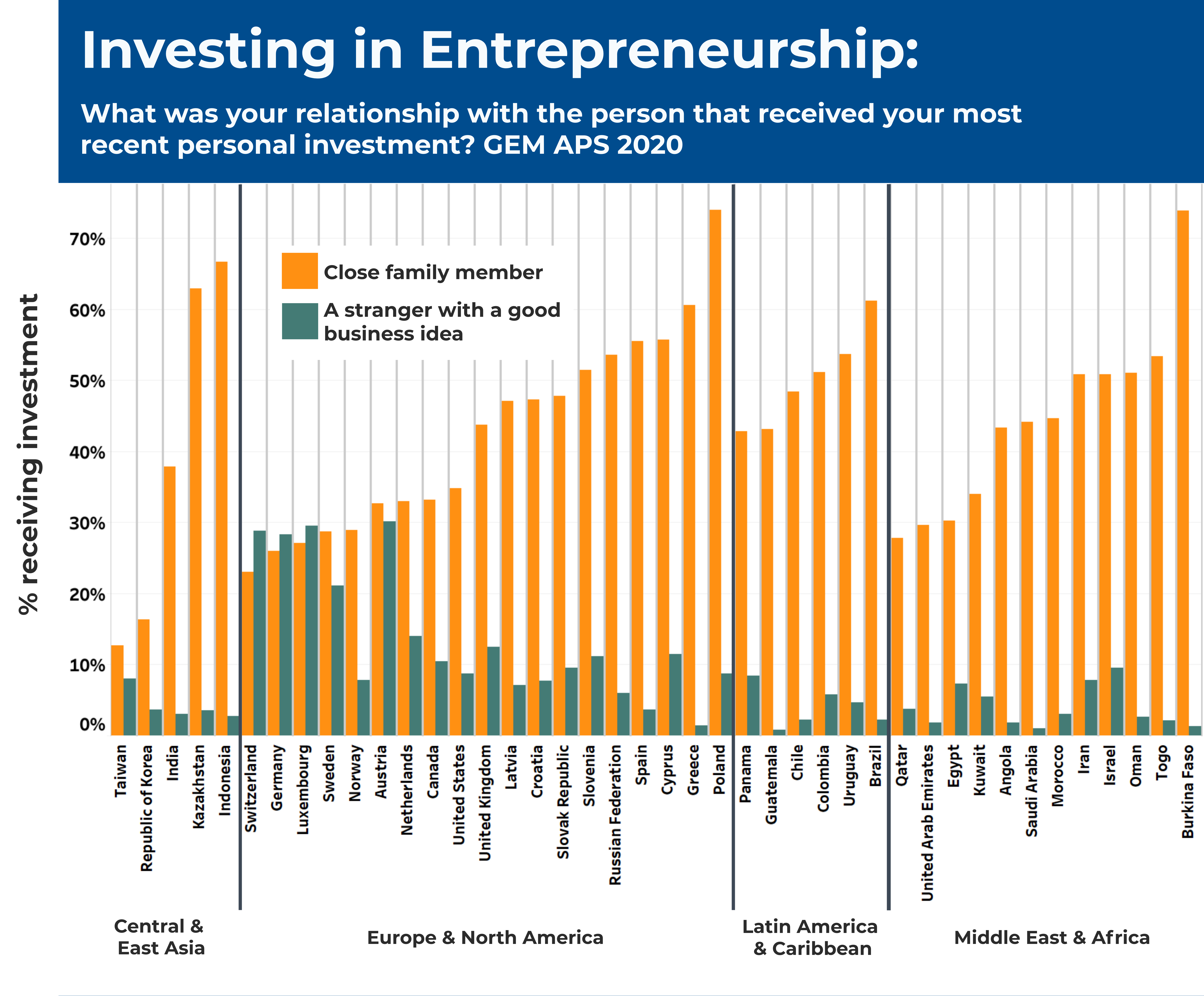

Every year, GEM teams ask respondents if they have invested money, excluding stock or mutual fund purchases, in a new business started by someone else. If they have invested money, they are then asked to specify their relationship to the person who received the investment. In almost all instances, GEM teams have found that most of the investors are providing resources for a close family member – defined as a spouse, brother, child, parent or grandchild – over the options of other relatives, work colleagues, friends or neighbors, or a stranger with a good business idea.

Below, each 2020 participating GEM economy is graphed by the percentage of investing respondents who stated they had invested in close family members, as opposed to “some other relative.” These results are striking because they show a significant preference for investing in close family members over other relatives. This suggests that there is a qualitatively stronger level of trust, or at least desire to help, close family members over other family members when it comes to investing in a new business.

* minimum of 50 respondents who stated they had invested in a new business, excluding the GEM economy Italy

Similarly, investing with work colleagues was a significantly less popular option than close family members in all cases but Taiwan. These are somewhat surprising results considering that many people would be exposed to their colleagues’ business potential in a work setting.

The only category that rivaled and even exceeded in some cases investing in close family members is investing in a friend or neighbor. There was a strong preference for friends and neighbors over other potential investment categories in the GEM economies of Taiwan, the Republic of Korea, Germany, the United States and Qatar among a few others. In these economies, there tends to be a stronger belief in the business potential of friends or neighbors, or perhaps more trust in their ability to return the investor’s money, over close family members. This also might be due to family sizes, considering that in most economies where there is more investor preference for friends and neighbors, family sizes tend to be smaller than the global average, with the exception of Qatar which is close to the world average. However, more research would be needed to establish that relationship.

The final category available to respondents is “a stranger with a good business idea.” This would be someone who approached the respondent with a business opportunity, perhaps through a networking event or by a marketing campaign, or some other external method. This category generally does not get much investment compared to the categories of close family members or friends. In a few instances – such as Switzerland, Germany and Luxembourg – strangers with good business ideas outperformed close family members in terms of investment preference. This may also relate to the fact that these economies do not have a high rate of close family members compared to most GEM economies.

While in 2020 most GEM economies demonstrated a preference for investing with close family members, this rate slipped compared to the 2019 results of GEM economies that participated in both cycles (there were a few exceptions). This would not necessarily be due to an overall investment reduction occurring in 2020 due to the financial constraints of COVID-19, because the rates are proportional to the total investment each year. Therefore, the 2020 results show a general decline in preference for investing in close family members; a surprising result considering that the uncertainty related to COVID-19 and the business instability would make people more inclined to keep their investments close to home.

However, one year does not determine a clear trend. The 2021 results will provide additional data points to consider if these preferences are lasting.