By Peter Josty, Head of the GEM Canada Team

Entrepreneurship is thriving in Canada, according to the latest GEM Canada National Report.

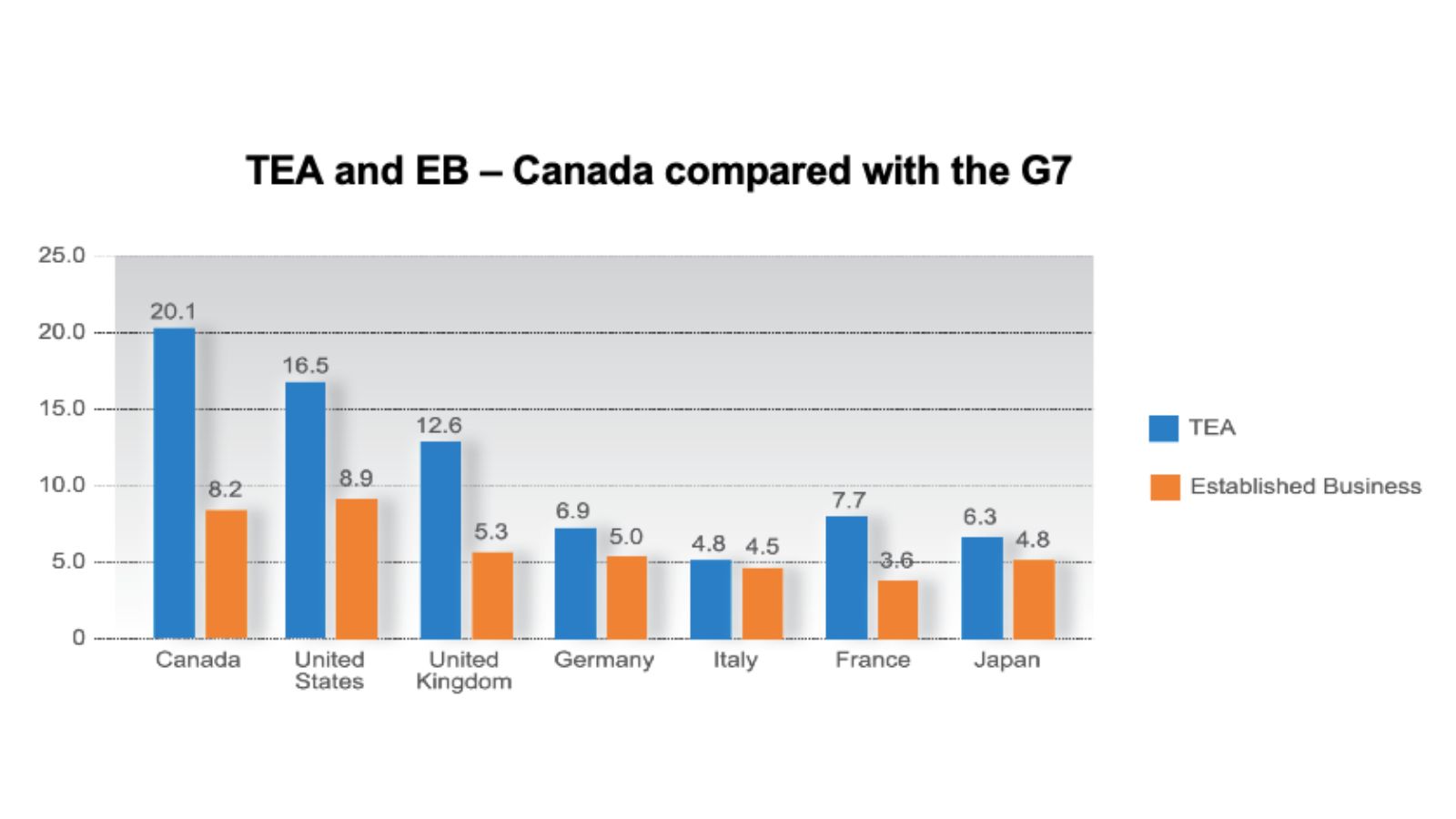

GEM measures two metrics for entrepreneurial activity – TEA (Total early-stage entrepreneurial activity) and EB (established businesses). TEA consists of the fraction of the adult population actively planning to start a new business plus those running a business less than 42 months old. EB are businesses older than 42 months. The graph below shows how Canada compares with other G7 countries. Canada has the highest level of TEA in the G7, and the second highest EB level.

Attitudes

Attitudes

Canadians are expressing many positive perspectives about entrepreneurship according to the research.

- More than half know an entrepreneur personally,

- Nearly 50% believe they have the skills to start a business, and

- 23% have plans to start a business.

However, there was some caution shared as 53% say fear of failure would hold them back from starting a business, the second highest level in the G7 (Canada, US, UK, France, Germany and Japan). 7 out of 10 Canadians feel that they see good opportunities to start a business.

Funding

Canada ranks first amongst G7 countries in identifying business angels as an important source of funds for new businesses, and was first in level of informal investment. Canada also had the highest average level of funds in the G7; a significant increase from 2020. One explanation for higher investment in 2021 was the need for angels to provide follow-on funding to help investee companies survive economic hardship during the height of the pandemic in 2020, with angels now seeking new investment opportunities.

What kinds of business were started?

In common with all the G7 countries, consumer oriented services is the largest category of new businesses, representing 52% of all new businesses. This is followed by business oriented services (26%), manufacturing (19%) and extractive industries (3%). This last category includes agriculture mining and oil and gas extraction.

What are their growth plans?

GEM has a number of growth measures and in 2021 all of them showed positive increases compared with 2020. 16% of start-up entrepreneurs and 12% of established businesses expect to create 10 or more jobs in the next 5 years.

Export orientation

Canada has the highest level of export orientation among G7 countries. 4.3% of startups and 1.2% of established businesses have 50% or more of their revenue from outside the country. This is a very good sign and is probably explained by the fact that Canada is a small export oriented economy.

Who are the entrepreneurs?

The most common age range for Canadian entrepreneurs is 25-34 (30% of all startups). Younger entrepreneurs (18-24) were not far behind at 28%. Older entrepreneurs have lower activity – 23% for the 35-44 age group; 12% for 45-54 and 9% for the 55-64 age group.

The gender ratio for startups varies quite a lot from year to year. In 2021, the male TEA rate rose by 40% compared to 2021, while the female TEA rate rose by 14%. The female TEA rate was 65% of the male TEA rate. The gender ratio for established businesses tends to be much more stable, the female EB rate being 68% of the male EB rate in 2021. Both the male and female TEA rates were the highest in the G7.

Canadian entrepreneurs are highly educated. 22% of all TEA entrepreneurs have graduate experience, 21% have a post-secondary degree, 19% have high school diploma and 15% have some high school or lower. Canada’s entrepreneurs possessed the highest educational rates across three of the four educational levels.

How innovative are the entrepreneurs?

In common with other countries, most startups are not very innovative. In 2021, in Canada, 46% of entrepreneurs said their product or service was not new. 30% said their product or service was new to people where they lived and 15% said their product or service were new to the country. However 9% of entrepreneurs said their product or service was new to the world. This is a very encouraging number as it demonstrates their strong competitive advantage.

What motivates the entrepreneurs?

GEM asks a series of questions to probe motivation, as shown in the table below. There are significant differences between male and female entrepreneurs.

|

Motivation |

Male |

Female |

|

To make a difference in the world |

16.3 |

12.0 |

|

To make great wealth |

16.5 |

10.9 |

|

To follow a family tradition |

13.2 |

6.8 |

|

To earn a living because jobs are scarce |

17.6 |

10.7 |

The biggest motivator for male entrepreneurs in 2021 was “to earn a living as jobs are scarce,” which probably reflects the turmoil caused by COVID. For female entrepreneurs, the biggest motivator was “to make a difference in the world.”

Support for entrepreneurs

GEM identifies 13 framework conditions that support entrepreneurs. Canada mostly ranks in the middle of the pack when compared with other G7 countries. Canada was ranked highest for “government policies bureaucracy and taxes”, and second highest, behind the US, for “cultural and social norms”. Canada ranked well for entrepreneurial education at primary and secondary schools but poorly for entrepreneurial activities at colleges and universities. Two areas where Canada is ranked poorly are R&D transfer and physical infrastructure.

Conclusion

2021 was a difficult year for the economy because of COVID. Nevetheless, entrepreneurs in Canada were very active and in many cases led their G7 peers. The study revealed strengths and weaknesses in the entrepreneurial support system, with particular attention needed to improve R&D transfer and physical infrastructure

Access the National Report. In addition, GEM Canada has published reports for Saskatchewan and Quebec.