There is a great opportunity to understand the entrepreneurial ecosystem of a particular region with GEM’s Entrepreneurial Ecosystem Index (ESI). Attendees of last month’s EU Regions Week panel “Boosting Startups and Scale-ups” were able to hear about this first-hand.

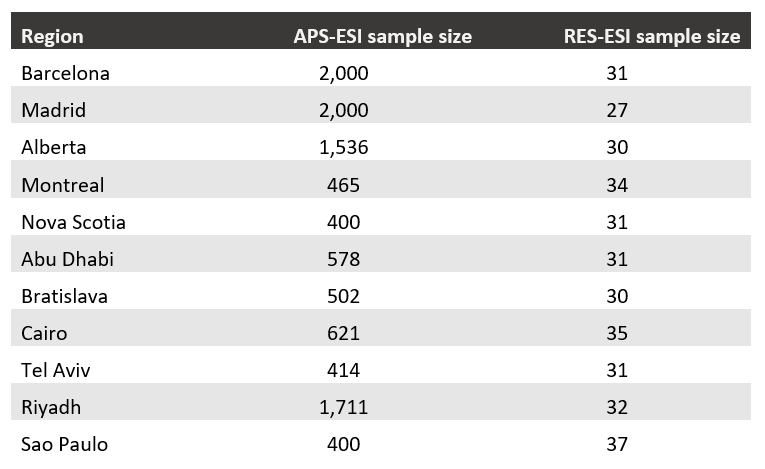

The ESI takes a targeted approach to studying entrepreneurship, surveying a representative sample of a region’s adult population (at least 400 respondents), as well as a panel of 30+ experts, to assess that region’s entrepreneurial ecosystem. Both the policy need for this tool and its results across 11 regions were discussed in detail at the Regions Week session by entrepreneurship researchers Niels Bosma, Erik Stam, Alicia Coduras and Rolf Sternberg.

Background

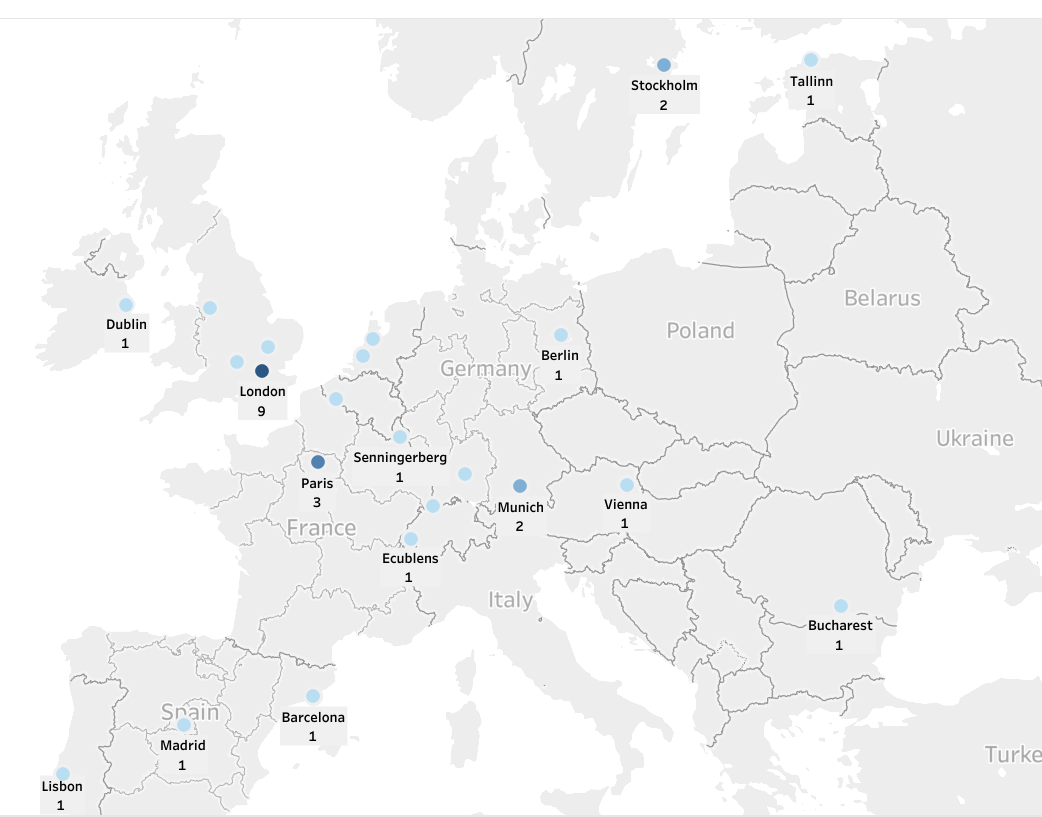

Dr. Stam outlined the manifold benefits of entrepreneurship to regional economies, including the aggregate economic impact, job creation and innovative problem-solving outputs of productive firms. But, as Stam noted, entrepreneurship is hyper localized to a few select regions. He based this finding of hyper localized productive entrepreneurship on a number of metrics. One example is the number of “unicorns,” defined as new startup firms worth over $1 billion, within all European regions.

Below is a distribution of the 37 unicorns by their European city, as of 2019. London leads with nine unicorns, followed by Paris with three.

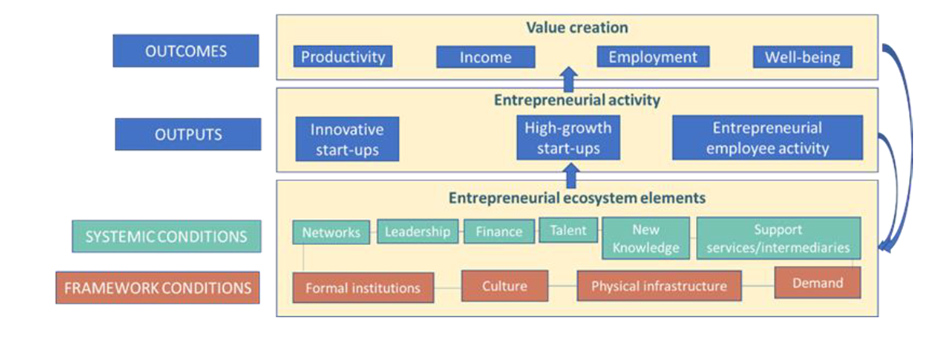

So, if high-value entrepreneurship is so unevenly spread, how to other regions boost their own startup potential so entrepreneurs can thrive? As Stam and many other experts have demonstrated in the recent academic literature, regions can improve their chances to generate innovative firms by creating their own high-quality entrepreneurial ecosystems that entail the following interdependent set of conditions:

Assessing an Ecosystem’s Strengths and Weaknesses

In order to boost high-value entrepreneurship, regions need to assess their ecosystem’s strengths and weaknesses, particularly on the conditions in Stam’s model above. This is where ESI can help. The tool, developed in large part by GEM NES Manager Alicia Coduras and GEM Germany Team Member Rolf Sternberg, is designed to measure the conditions outlined above. This is accomplished using a sample of at least 400 adults drawn from a representative sample, as well as a mix of experts familiar with the region. By surveying both groups, regions can determine how potential entrepreneurs in the adult population as well as relevant experts view their ecosystem.

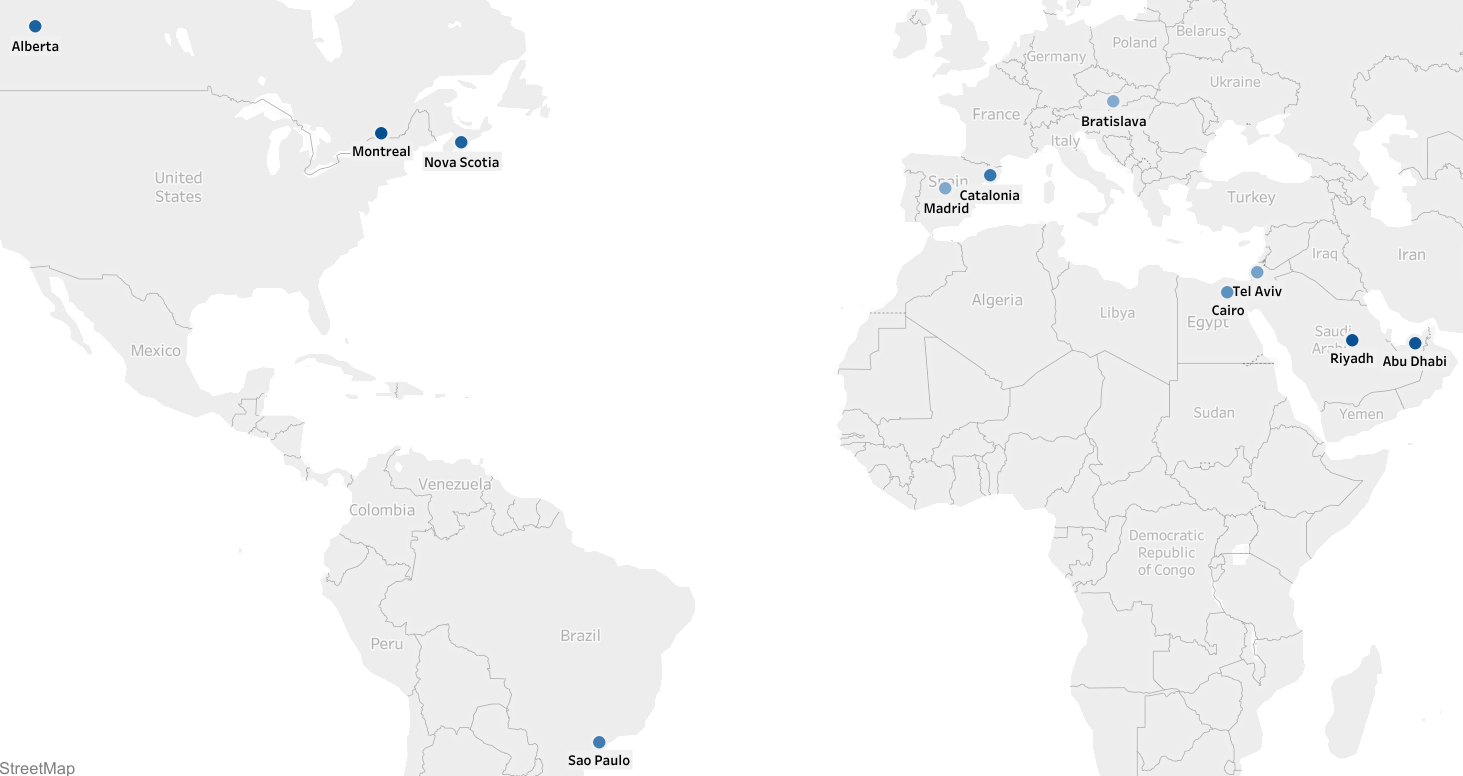

In 2019, 11 regions participated in GEM’s first large-scale ESI survey. The regions are mapped below:

Additionally, below are the sample size for each participating region. The APS-ESI column contains the size of each region’s adult population sample, and the RES-ESI column contains the number of experts surveyed:

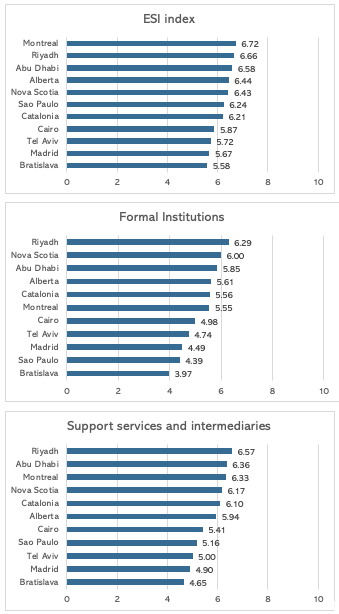

These regions were surveyed on questions related to the quality of their ecosystem. With these responses, scores were generated for the ecosystem as a whole, which were based on the aggregate scores of each of the regions’ 10 underlying conditions. Below, the overall scores (ESI Index) are provided, as well as scores on two of the 10 underlying conditions, Formal Institutions and Support Services and Intermediaries. These two conditions were chosen because they are most directly related to policymaking, which was the main theme of the Regions Week panel.

This is only one year of surveys, so it is difficult to determine a significant trend in the results. However, as the panelists in the EU Regions Week session noted, the hope is to eventually to show trends over time. The idea is to first develop a set of relevant benchmarks so that regions can compare themselves to other regions in their peer group and make strides in the relatively weaker areas. Additionally, policymakers will be able to determine if their policies are having an impact. These are the foundational steps in boosting regional entrepreneurship.

If you would like to participate in the GEM ESI project, please email info@gemconsortium.org for more information.

Forrest Wright, GEM Data Team