By Peter Josty

Among the many benefits of being part of Global Entrepreneurship Monitor (GEM) is the opportunity for economies to benchmark key entrepreneurship data against peer countries. Canada, an early member of the consortium, generated many positive results in the latest GEM Global Report entitled Adapting to the New Normal.

GEM Reports are based on surveys of individual entrepreneurs, while most other reports on entrepreneurship look at businesses. Think of this as a top down versus bottom up approach. GEM data provides insight into the plans that entrepreneurs have for the future and information on motivation and challenges that cannot be found in business data.

The latest report is based on 176,000 surveys in 50 countries carried out in 2022. GEM uses three country classifications:

- Countries with GDP per capita of more than $40,000 USD [Level A countries]

- Countries with GDP per capita between $20,000-$40,000 [Level B countries]

- Countries with GDP per capita of less than $20,000 [Level C countries]

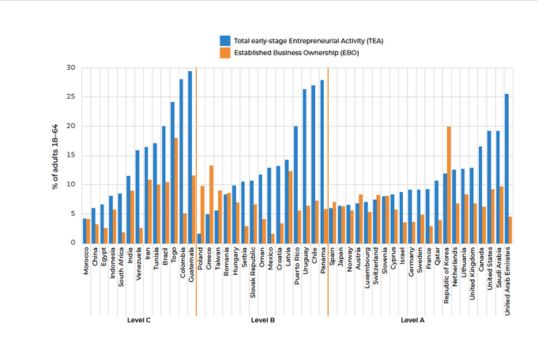

As noted in the below graphic, Canada is among the Level A countries with the highest Total Entrepreneurial Activity rate (TEA – the percentage of adults aged 18-64 who are starting or running an early stage business). For several years, Canada outpaced the US in TEA. But in 2022, the TEA rate in Canada dipped and the rate in the US rose, overtaking Canada. In 2022, about half of the high income countries showed an increase in entrepreneurship and half showed a decrease from 2021. This is likely related to COVID-19 recovery and local responses.

For Established Business Ownership (EB) – the percentage of adults who are currently the owner-manager of a business more than 42 months old – Canada was in the middle of the pack (higher than many European countries but lower than the US).

There is a marked contrast between entrepreneurship in Europe and North America. Canada and the US have TEA levels at least twice those of most European countries. Exits are also very different. Exits can mean two things – the business closes down, or it continues under new management. Canada and the US have exit rates two to three times higher than most European countries, in both categories. This indicates that there is much more churn in North America – more startups and more failures. In general, there is a correlation between high startup rates and high exit rates in all GEM countries.

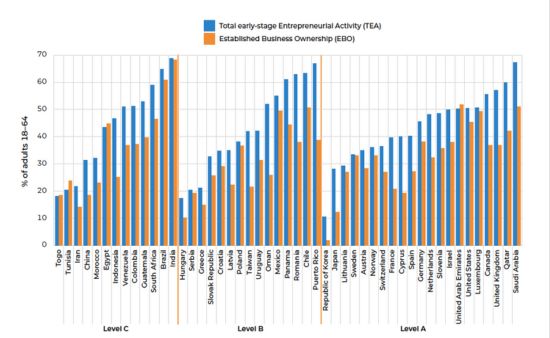

The GEM Global Report provided data on how the pandemic impacted entrepreneurs. Adversity can present opportunities, as well as threats. Many entrepreneurs around the world saw opportunities arising from the pandemic. The graphic below shows the percentage of those starting a new business (and running an established business) who agree that the pandemic led to more opportunities.

Canada ranks highly on this scale, particularly for start ups. There is quite a range in Level A, B and C countries, which likley reflects local conditions.

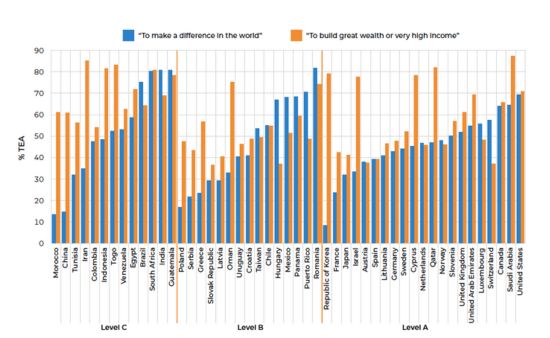

Also, GEM uses a number of different metrics to measure entrepreneurs’ motivation. One metric is “to continue a family tradition”. On this count, Canada ranks very highly among Level A countries, second only to Saudi Arabia. Another metric is “ To earn a living because jobs are scarce”. Here Canada ranks in the middle of the pack among Level A countries, with 58.5% of entrepreneurs responding “yes” to this. Results for this metric are much higher in Level B and C countries, many recording 80-90% answers to this question.

Two other metrics GEM uses are “To make a difference in the world” and “ To build great wealth or very high income”. The graphic below shows the Canadian responses are almost equal for these two questions.

Governments in Canada find GEM research useful as it provides evidence-based policy development.

Peter Josty is Head of the GEM Canada Team. The full report is available at this link. You can also watch a recording of the GEM National Reports webinar featuring Geoff Gregson, Lead Author of the GEM Canada National Report.